Page 184 - ΝΑΥΤΙΚΑ ΧΡΟΝΙΚΑ - ΜΑΙΟΣ 2023

P. 184

ANALYSIS

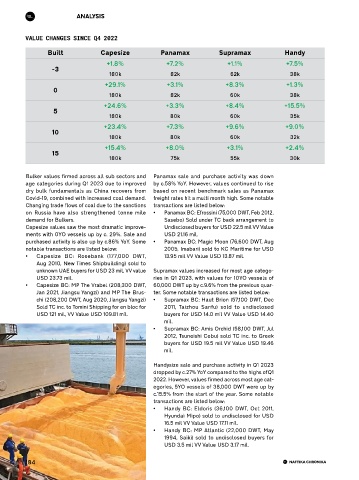

VALUE CHANGES SINCE Q4 2022

Built Capesize Panamax Supramax Handy

+1.8% +7.2% +1.1% +7.5%

-3

180k 82k 62k 38k

+29.1% +3.1% +8.3% +1.3%

0

180k 82k 60k 38k

+24.6% +3.3% +8.4% +15.5%

5

180k 80k 60k 35k

+23.4% +7.3% +9.6% +9.0%

10

180k 80k 60k 32k

+15.4% +8.0% +3.1% +2.4%

15

180k 75k 55k 30k

Bulker values firmed across all sub sectors and Panamax sale and purchase activity was down

age categories during Q1 2023 due to improved by c.58% YoY. However, values continued to rise

dry bulk fundamentals as China recovers from based on recent benchmark sales as Panamax

Covid-19, combined with increased coal demand. freight rates hit a multi month high. Some notable

Changing trade flows of coal due to the sanctions transactions are listed below:

on Russia have also strengthened tonne mile • Panamax BC: Efrossini (75,000 DWT, Feb 2012,

demand for Bulkers. Sasebo) Sold under TC back arrangement to

Capesize values saw the most dramatic improve- Undisclosed buyers for USD 22.5 mil VV Value

ments with 0YO vessels up by c. 29%. Sale and USD 21.16 mil.

purchased activity is also up by c.86% YoY. Some • Panamax BC: Magic Moon (76,600 DWT, Aug

notable transactions are listed below: 2005, Imabari) sold to KC Maritime for USD

• Capesize BC: Rosebank (177,000 DWT, 13.95 mil VV Value USD 13.87 mil.

Aug 2010, New Times Shipbuilding) sold to

unknown UAE buyers for USD 23 mil, VV value Supramax values increased for most age catego-

USD 23.73 mil. ries in Q1 2023, with values for 10YO vessels of

• Capesize BC: MP The Vrabel (208,300 DWT, 60,000 DWT up by c.9.6% from the previous quar-

Jan 2021, Jiangsu Yangzi) and MP The Brus- ter. Some notable transactions are listed below:

chi (208,200 DWT, Aug 2020, Jiangsu Yangzi) • Supramax BC: Haut Brion (57,100 DWT, Dec

Sold TC inc. to Tomini Shipping for en bloc for 2011, Taizhou Sanfu) sold to undisclosed

USD 121 mil, VV Value USD 109.81 mil. buyers for USD 14.0 mil VV Value USD 14.40

mil.

• Supramax BC: Amis Orchid (58,100 DWT, Jul

2012, Tsuneishi Cebu) sold TC inc. to Greek

buyers for USD 19.5 mil VV Value USD 19.46

mil.

Handysize sale and purchase activity in Q1 2023

dropped by c.27% YoY compared to the highs of Q1

2022. However, values firmed across most age cat-

egories, 5YO vessels of 38,000 DWT were up by

c.15.5% from the start of the year. Some notable

transactions are listed below:

• Handy BC: Eldoris (36,100 DWT, Oct 2011,

Hyundai Mipo) sold to undisclosed for USD

16.5 mil VV Value USD 17.11 mil.

• Handy BC: MP Atlantic (22,000 DWT, May

1994, Saiki) sold to undisclosed buyers for

USD 3.5 mil VV Value USD 3.17 mil.

184