Marek Dietl: Capital markets of the Three Seas region – (un)used potential

There are two poles of rapid economic growth in the European Union – Ireland in the West and the twelve countries of the Three Seas Initiative, whose economies have grown by 2.8% per annum since they joined the EU. International investors have yet to use the full the potential of this rapid growth rate in the region.

It does not take a keen observer of economics to notice a relationship between economic growth and stock quotations. Despite the hundreds of papers written to explain the correlation, we still do not know whether it is the capital market that drives the growth or whether strong stock exchanges are the result of economic prosperity. The most likely explanation seems to be that there is a sort of feedback between the two. Public capital markets are the perfect tool for turning savings into investment, but the investment will only make sense if one can expect attractive returns, and these are related to economic growth.

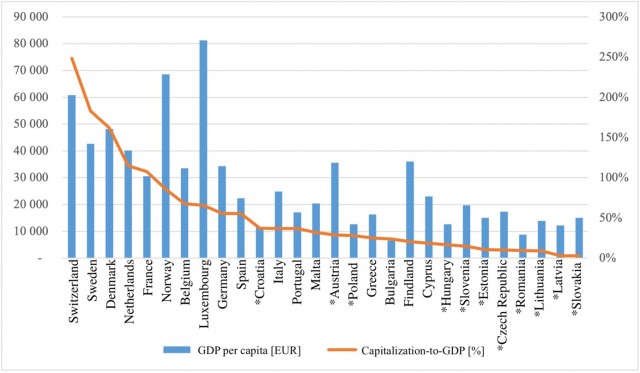

As we analyse the relationship between GDP per capita and the share of the market capitalisation of listed companies in the GDP figures of different countries in the European Economic Area, it becomes clear that “rich” countries also have “larger” capital markets. In the Three Seas countries, such markets are usually less developed than it might seem from the state of their economies.

A country that has grown fast and yet has quite a large capital market compared to its GDP is Poland. Over the last 30 years, Polish GDP has more than tripled, which implies real economic growth of an average of 4% per annum. At the same time, the main stock exchange index, WIG, grew at an average rate of over 15% over these three decades. The Warsaw Stock Exchange lists companies with higher growth than the national average, attracting investors whose presence encourages more successful companies to float on the market.

Despite Poland’s undisputed success, its capital market still has a lot of growth potential. The share of capitalisation in GDP oscillates between 30% and 40%, a figure that is twice lower than in the so-called old EU countries.

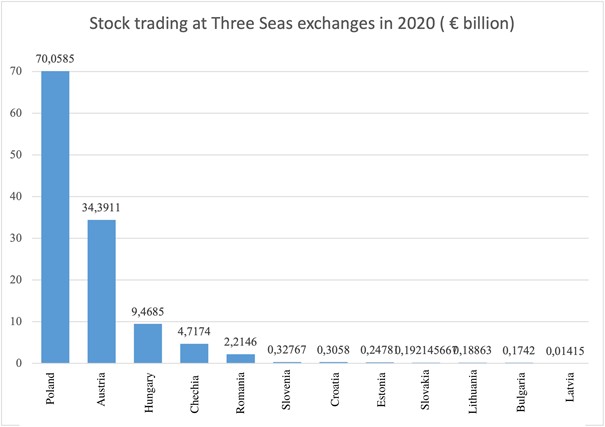

Even though the companies listed on the Three Seas stock exchanges flourish, their ability to attract investors and, consequently, other companies are undermined by the economies of scale. Almost 85% of turnover is generated by the three biggest markets in the region, which is why it seems necessary that they should cooperate more closely. A joint offer for global investors will provide dynamic companies with an opportunity to raise regional capital that will not try to control them.

One example of such cooperation is the CEEplus index. Introduced in 2019, it now covers 153 companies from seven countries of the region: Poland, Croatia, the Czech Republic, Romania, Slovakia, Slovenia, and Hungary. Due to its diversity of countries and industries, the index has attracted growing interest from funds and investors worldwide.

The area of cooperation that is particularly important for the WSE is technology. The region’s stock exchanges are already testing some of our solutions. In the future, our export product will be a unique transaction system adapted to the specific nature of small stock exchanges that will make it possible to create a single technological ecosystem for the capital markets of this part of Europe.

The WSE also holds the Three Seas Stock Exchanges Conference, a platform dedicated to the exchange of experiences.

The Warsaw Stock Exchange is currently the undisputed leader of the group. Two decades ago, the Athens Stock Exchange was four times larger than the WSE in terms of capitalization and over two times larger in terms of turnover. Today, it is the stock exchange in Warsaw that is four times larger than the one in Greece. This breakneck pace of growth has given Poland unique know-how on how to develop capital markets.

The Three Seas Initiative was launched to address the transport and transmission infrastructure gaps on the North-South axis. As it was being developed, we noticed similar shortcomings in capital markets. While cooperation between regional stock markets and the largest markets in the West thrived on many levels, relations between the northern and southern parts of the region were very weak.

It is high time to change this for the benefit of the thousands of regional companies that want to raise capital and the investors looking for an opportunity to multiply their savings. Acting with caution and courage as the region leader, the Warsaw Stock Exchange is ready to take on this challenge.

ΝΧ

Συντακτική ομάδα Ναυτικών Χρονικών

Ίδρυμα «Αθανάσιος Κ. Λασκαρίδης»: Το έμπρακτο «ευχαριστώ» στις Ελληνικές Ένοπλες Δυνάμεις

«Ο κύριος και η κυρία Λασκαρίδη επέλεξαν να τιμήσουν αυτή τη σπουδαία προσφορά σας με ένα συμβολικό δώρο, την κατασκευή ενός ειδικού ρολογιού ελληνικής…

«KASTOS», το νεότευκτο δεξαμενόπλοιο της Oceangold Tankers

Το νεότευκτο δεξαμενόπλοιο «KASTOS» παρέλαβε πρόσφατα η Oceangold Tankers, επικεφαλής της οποίας είναι ο κ. Γιάννης Δράγνης. Συγκεκριμένα, βάσει ανακοίνωσης του κινεζικού ναυπηγείου Shanghai…

Δασμοί Ντ. Τραμπ: Με ερωτηματικό η έναρξη ισχύος

Ο πρόεδρος των ΗΠΑ Ντόναλντ Τραμπ ανακοίνωσε χθες Δευτέρα την απόφασή του για επιβολή δασμών τουλάχιστον 25% στις εισαγωγές από αρκετές χώρες, συμπεριλαμβανομένων της…

Ισραηλινά πλήγματα με στόχο πλοία και λιμάνια

Η Ambrey, ανακοίνωσε σήμερα ότι περιήλθε σε γνώση της οπτικό υλικό το οποίο επιβεβαιώνει πως έχουν υποστεί ζημιές οι αποβάθρες στο λιμάνι στη Χοντάιντα,…

Ελληνικό νηολόγιο: Η ψήφος εμπιστοσύνης της Capital-Executive Ship Management

Η Capital-Executive Ship Management Corp. ολοκλήρωσε με επιτυχία τη διαδικασία νηολόγησης του bulk carrier M/V «ARISTOMENIS» (Φ/Γ “ΑΡΙΣΤΟΜΕΝΗΣ”) στο ελληνικό νηολόγιο. Το M/V «ARISTOMENIS»…

Δυναμική είσοδος του Βόλου στον χάρτη των θαλάσσιων αερομεταφορών

Η Hellenic Seaplanes προσθαλασσώθηκε στο λιμάνι του Βόλου, ανοίγοντας ένα νέο κεφάλαιο στις θαλάσσιες αερομεταφορές. Το υδροπλάνο της εταιρείας προσέγγισε την κεντρική προβλήτα μπροστά…

Τροπική καταιγίδα πλήττει την Κίνα: Οι θαλάσσιες μεταφορές στο επίκεντρο

Η τροπική καταιγίδα Ντάνας κατευθύνεται προς την ανατολική Κίνα σήμερα το πρωί, με την επαρχία Τζετζιάνγκ να ετοιμάζεται για την άφιξη του φαινομένου το…

Νέα επίθεση σε ελληνόκτητο πλοίο στην Ερυθρά Θάλασσα

Ένα ακόμη σοβαρό επεισόδιο εκτυλίχθηκε στην Ερυθρά Θάλασσα, 51 ναυτικά μίλια δυτικά της Al Hudaydah. Σύμφωνα με την UKMTO εμπορικό πλοίο δέχθηκε επίθεση από…